What is a Debit Card?

While we work in this industry, we often think people know what we do. So, it's sometimes interesting to see what questions people ask on Google.

It turns out that many people like you are asking, "What is a Debit Card?" and we’re here to help you.

Here’s the good news up front, before we answer all your burning questions. We offer a debit Mastercard with our free money app and personal account, which also includes our very own GreenScore to help you track how sustainable your spending is for the planet.

Our service has one main difference from others - We promise that we won’t invest in anything that harms the planet, which is why we're a sustainable alternative to banking.

You can easily set up by downloading our App.

Right, let's get into all your burning questions. No stress—we’ve broken it all down below so you can get all the info you’re looking for.

What is a Debit Card?

Debit cards let you use the money you already have in your account. When you buy something or take out cash with a debit card, the system quickly takes the money from your account.

Why is it a good thing?

- You can make purchases without needing to carry physical cash

- Withdraw funds from ATMs (note: daily limits and potential fees may apply)

Debit cards let you spend money in your account. Credit cards let you borrow money up to a set limit. For instance, if you’ve deposited £100, your debit card access stops there—you can only spend what’s available.

When you buy something or take out cash with a debit card, the system quickly takes the money from your account. If you spend more than your balance, you could enter an overdraft, which may result in extra charges.

What is a prepaid debit card?

A prepaid debit card works like a regular debit card. You can use it for spending and cash withdrawals. But the main difference is that you need to load or ‘top up’ a prepaid card with funds. You cannot spend more than what is on the card.

With a 'standard' debit card, you may have an overdraft. You can use this overdraft if your provider agrees.

What is an overdraft?

An overdraft is a type of short-term borrowing where you can spend more money than you have in your account, up to an agreed limit.

This is something that needs to be agreed with your provider before use, otherwise you could be liable for additional charges, which could be very expensive.

Once in place, it then allows you to access funds beyond your current account balance, essentially borrowing from your provider for a specific time without a charge.

What is a CVV, and why is it important?

Your CVV (Card Verification Value) is a small but important number that helps protect your card when shopping online.

Think of your CVV as a digital lock. It helps prove that you actually have the card in hand, which makes online shopping safer and helps prevent fraud.

A Few Things to Remember:

Your CVV is not your PIN (the number you use at ATMs or in stores).

Never enter your PIN when asked for your CVV.

People also know CVV codes as CSC (Card Security Code) or CVV2. These are just different names for the same thing. New technology makes them harder to guess.

For Visa, Mastercard, and Discover cards, it’s a 3-digit number on the back of your card.

For American Express, it’s a 4-digit number on the front.

What is the difference between a credit card and a debit card?

Debit cards let you spend money in your account. Credit cards let you borrow money up to a set limit. For instance, if you’ve deposited £100, your debit card access stops there—you can only spend what’s available.

What debit card should I pick?

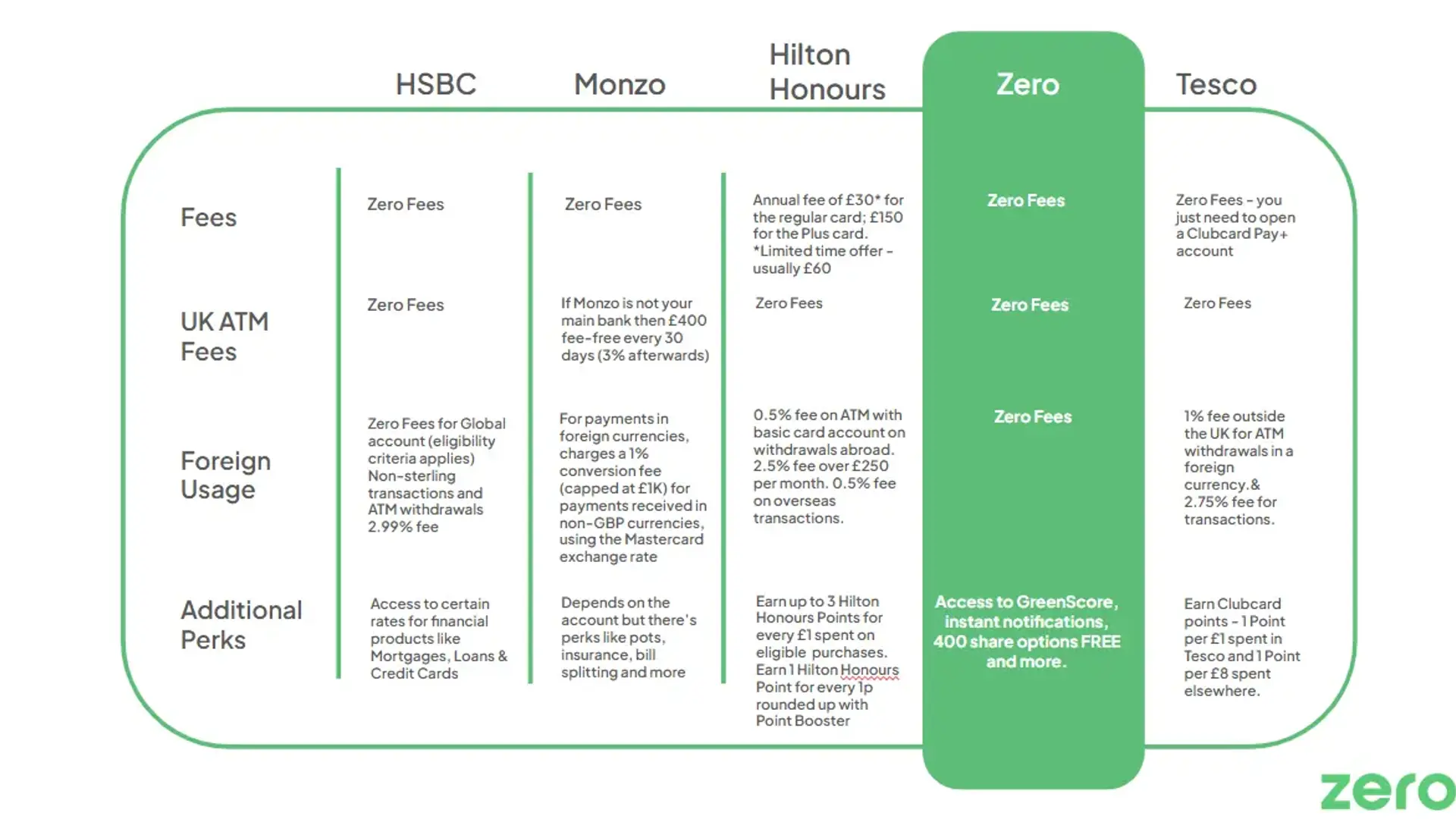

That answer depends on how you’re likely to use your debit card. Let’s compare some popular debit cards, including the Zero Mastercard debit card. This will help you see what to expect and why Zero might be the best choice for you.

What do I do if my debit card is lost or stolen?

The first thing you need to do is contact your provider immediately if your card is lost or stolen, or you don’t recognise a transaction. Most Apps like Zero allow you to ‘freeze’ your card to stop any spending or if you don’t have this feature, it’s best to call, and usually there is a dedicated line.

Top things to remember

- Freeze your card using online or mobile app

- Speak to your providers fraud department by phone or live chat as soon as possible

Tips to keep your debit card safe

Prevention is better though, especially with most cards allowing you to spend up to £100 with a simple tap and not needing a pin. So, here’s some advice to try and avoid having to freeze your debit card.

- Never give your card or PIN to anyone

- Don’t write your PIN down

- Don’t use a number that could be easily guessed by others, like your birthday

- Report suspected fraud and lost or stolen cards straight away.

- Instant spending notifications – these tell you every time your card is used, so you can spot unusual activity quickly.

- Daily spending and cash withdrawal limits – your card will automatically stop if these are reached.

Fraudsters can be very clever and are quick to set up new scams to target people, and it can be very hard to detect. You should always be wary when anyone asks for personal information or your card details that could leave you an option to risk and fraud. If in doubt, don’t do it. See how to spot a scam for full help.

Top Tip: Say you need to check with your partner or child and end the call, then call your provider directly to find out if it was them.

Final thoughts…

When picking a debit card, think about your spending habits, how often you travel and what would be a benefit to you.

Finally, check for any fees. Be sure to review the most current terms and conditions directly from the providers, as offerings can change over time.

Then you’ll find the best fit for you. Money Saving Expert also has some good content to read before making your choice and it costs you nothing to do more research.

Want to know where we got our info?

Here is where we found information on other debit card providers. You can check the info yourself or click the link for all Zero Fees & Charges.

Compare providers - Compare Providers I Hilton honours debit card I Tesco I HSBC fees I Monzo travel - Monzo fees